Projects During the Course

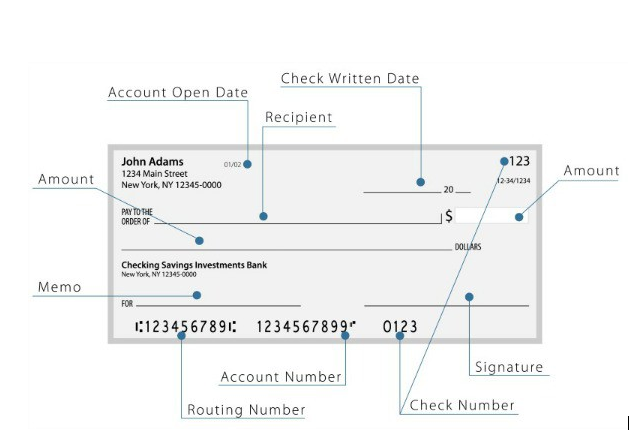

1-Making Your Own Check/Making a Register

|

Using the example:

|

Example of a Register

Jonny Register

Date Transaction Amount Running Total

01/05/24 Pay Check +$100.00 $100.00

01/05/24 Information Access Fee (-$100.00) Free ($100) $100.00

01/05/24 Rent -$50.00 $50.00

01/05/24 Security Deposit -$50.00 $0.00

01/08/24 Survey Bonus +$50.00 $50.00

01/10/24 Bonus for signing "Terms and Conditions" +$100.00 $150.00

01/10/24 Gold Insurance -$150.00 $0.00

01/12/24 Pay Check +$250.00 $250.00

01/12/24 Informational Access Fee -100.00 $150.00

01/12/24 Rent -50.00 $100.00

***Start your register and email a copy to [email protected]***

***Take a screensot of your stock market data showing name, net worth, and ranking***

Jonny Register

Date Transaction Amount Running Total

01/05/24 Pay Check +$100.00 $100.00

01/05/24 Information Access Fee (-$100.00) Free ($100) $100.00

01/05/24 Rent -$50.00 $50.00

01/05/24 Security Deposit -$50.00 $0.00

01/08/24 Survey Bonus +$50.00 $50.00

01/10/24 Bonus for signing "Terms and Conditions" +$100.00 $150.00

01/10/24 Gold Insurance -$150.00 $0.00

01/12/24 Pay Check +$250.00 $250.00

01/12/24 Informational Access Fee -100.00 $150.00

01/12/24 Rent -50.00 $100.00

***Start your register and email a copy to [email protected]***

***Take a screensot of your stock market data showing name, net worth, and ranking***

2-Economics Project: In The News

Read, then write a paragraph about a NEWS article (not a definition but an actually news report) for each topic, and state the source (copy the link):

(IN YOUR OWN WORDS...DO NOT COPY AND PASTE)

Federal Reserve

Tariffs, Quotas, Embargoes (pick one)

Inflation

(you will have 3 paragraphs...one for each topic)

Read, then write a paragraph about a NEWS article (not a definition but an actually news report) for each topic, and state the source (copy the link):

(IN YOUR OWN WORDS...DO NOT COPY AND PASTE)

Federal Reserve

Tariffs, Quotas, Embargoes (pick one)

Inflation

(you will have 3 paragraphs...one for each topic)

3-Project Banking

Compare Wells Fargo vs Ally

1) Savings account rate (APY), opening deposit, minimum balance, monthly fee (find these numbers)

2) 1 year CD rate (APY), minimum required (if they have one)

3) Other banking opportunities each bank offers...student loans, car loans, etc. (list at least 3)

4) List 3 reasons why you might choose Wells Fargo over Ally

5) List 3 reasons you would choose Ally over Wells Fargo

6) Compare the savings interest rates between 3 other online banks (besides Ally)

4-Banking Worksheets (VIRTUAL ONLY)

(You can find the deposit form in the section labeled "FORMS")

Deposit 1:

Today’s date

Wal-Mart check…$230.78

Weekend work check…$100.00

Birthday check…$20.00

Cash from yard sale…5-$20, 6-$10, 2-$5, 7-$1, 81 quarters, 2 dimes, 20 nickels

Deposit 2:

Today’s date

Paycheck…$258.67

Cutting grass check…$176.87

Cutting grass cash…1-$50, 6-$20, 3-$5, 1-$1, 8 half dollars, 40 quarters, 5 dimes, I nickel, 1 penny

Deposit 3

Today’s date

Extended Education pay check…$150.98

Frank Miller’s check for babysitting…$45.00

Take out $50.00 cash for the weekend

Make a register for each:

(You can find the register form in the section labeled "FORMS")

A-previous balance=$1,235.65 B-previous balance=$456.42

#1234 8/2 K-Mart $123.56 #567 9/3 Sears $207.89

8/6 Paycheck $239.12 #568 9/4 Wal-Mart $178.09

#1235 8/10 Subway $10.50 9/6 Paycheck $245.78

#1236 8/23 Lowes $45.01 #569 9/10 Insurance payment $390.00

8/30 Paycheck $324.24 9/12 Overdraft charge $50.00

9/3 Weekend work check $125.98 9/13 Paycheck $300.00

#1237 9/10 Birthday gift $25.00

__________________________________________________________________________________________________________

Balancing a checkbook...Your friend asks for your help. She doesn't understand why her register doesn't match the bank's number. Can you help her?

Number Date Transaction Withdrawal Deposit previous balance: $532.91

#325 2/15 Krogers 256.78 276.13

2/19 Paycheck 210.32 486.45

#327 2/25 Dominion Power 214.63 271.82

#328 2/27 Sears 63.19 208.63

3/1 Paycheck 197.42 406.05

Bank statement = $328.10

Why the difference? _____________________________________________________

Balancing a checkbook... Another friend asks for your help. He doesn't understand why his register doesn't match the bank's number. Can you help him?

previous balance: $379.61

#103 9/17 Toys R Us 123.72 255.89

#104 9/20 Food Lion 98.67 157.22

9/20 Paycheck 356.81 504.03

#105 9/21 Merchant’s 320.78 183.25

#106 9/22 Wal-Mart 45.29 137.96

Bank Statement = $147.96 Why the difference? ________________________________

_________________________________________________________________________________________________________

5-Credit Card Project (bankrate.com)...4 Parts!

Part I: Credit Cards...go to bankrate.com...click on credit card... Find "Compare by credit"

Find a credit card for each column:

Name of Card Card 1 Card 2 Card 3

Rating Excellent Good Bad

Intro Offer

(annual percentage rate)

Regular APR

Transfer Balance APR

Annual Fee

Rewards

Part II: Write the definition of “Line of Credit”

Part III: Credit Card Minimum Payoff

bankrate.com

Part IV: Credit Card Article

1. go to: https://www.nasdaq.com/article/simply-saying-the-best-advice-about-credit-cards-youve-ever-heard-cm409844

2. Read then write 3 things that you agree or disagree with about the article.

6-Buying a Car/Truck

Kelley Blue Book (kbb.com) Part 1

7-Housing Project

House costing: find using Zillow

Description of your house: location, price (listed not estimate), # of rooms, square footage, # of bathrooms, size of the lot, age

If you used a FHA loan (Federal Housing Administration loan), you would need a 3.5% down payment.

down payment= cost of your home X .035 (write this down)

cost of your home - down payment = amount financed<---use in the problem for the amount borrowed

remember: the total cost of your home is the original price + the total interest paid

Bankrate.com

Monthly Payment Total Interest (whole length of the loan) Total Cost (original price + the total interest paid)

15 years:

6% ______________________

7% ____________

30 Years:

6% ____________

7% ____________

Q-1 What did you notice about the difference in total interest for the 15 year loan when compared to the 30 year loan? Total interest for 6% when compared to 7%. How much did you save in total interest by lowering your rate by 1% with a 30 year loan?

Q-2 What did you notice about the monthly payments for a 15 year loan compared to a 30 year loan? Monthly payment for 6% when compared to 7% with a 30 year loan...how much did you save?

Q-3 Using the amortization table for a 30 year loan at 7% interest rate, what do you notice about the amount of your payment that goes towards the principal and the interest in the beginning?

***Don't forget to negotiate your interest rate as well as the price of your home...save thousands!!!***

8-Car Insurance: https://www.moneygeek.com/insurance/auto/car-insurance-estimate-calculator/

Copy the following chart in a Google Doc and complete...

Female age: 30-65 Credit: excellent Driving record: clean vehicle type: sedan

Liability coverage: State Min Deductible: $500

Rates: Low_______ Average______High______

Change the age to 19-22

Rates: Low_______ Average______High______ What did you notice? ______________________________________

Why the change in price?_____________________________________________________

Change the Credit to Poor

Rates: Low_______ Average______High______ What did you notice? ______________________________________

Why do people with a low credit score have to pay more?_____________________________________________________

Change the Credit back to excellent and change the Gender to male

Rates: Low_______ Average______High______ What did you notice when comparing this number to a female driver? ________________________________________________________________

Why the change in price?_____________________________________________________

Change the Age to 23-25

Rates: Low _______ Average______High______ What did you notice? ______________________________________

Why the change in price?_____________________________________________________

Change the Driving Record to speeding

Rates: Low _______ Average______High______ What did you notice? ______________________________________

Why the change in price?_____________________________________________________

Change the Driving Record to accident

Rates: Low _______ Average______High______ What did you notice? ______________________________________

Why the change in price?_____________________________________________________

Change the Driving Record back to clean and change the deductible to $1,000

Rates: Low _______ Average______High______ What did you notice? ______________________________________

Why the change in price?_____________________________________________________

9-Car Insurance...Accident

Maria Andretti purchased an automobile insurance policy through an insurance agent

at the Wilson Insurance Agency. She paid a premium of $120 per month. Her policy includes the following:

• Bodily injury liability and property damage liability,

stated as “50/100/20”

• Collision insurance with a deductible of $1000

• Comprehensive insurance with a deductible of $500

Assume Maria is driving her car with a friend and is involved in an accident that was her fault. The driver also has a passenger in the car. Everyone – drivers and passengers – sustain injuries and require medical care.

10-Health Insurance Numbers

11-Finding Health Insurance

https://www.ehealthinsurance.com/

22963 zip code...go to "Individual and Family." Click on "Find Plans" Go to "Get Quote"....Fill out the information using the data below. Click on "See Plans."

Name of Policy 1st Policy 2nd Policy

The deductible:

Premium per month:

Co-Insurance:

Out of pocket limit:

Are prescription drugs covered?

Primary doctor copay:

Specialist copay:

Cost of hospital services:

Answer the following questions:

What is a copay?

If your insurance company covers 80% of the coinsurance, what does that mean?

What is an out of pocket limit?

Click on select plan. How much would it cost per month to add dental? ________ to add vision? ______

Comparing your two policies, why is the premium more for one over the other?

12-Home Owner's Insurance/ Renter's Insurance

Go to the following website...https://www.investopedia.com/insurance/homeowners-insurance-guide/

Answer these questions for home owner's insurance:

1) What does a home owner's policy cover? (list 3 things)

2) What is the difference between actual cash value and replacement cost?

3) What is a rider policy?

4) What is generally not covered under your homeowner's policy that requires an additional policy? (list 3)

5) What does liability cover?

6) What is additional living expense?

7) The premium for your homeowner's policy is determined by what factors? (list 3)

For renter's insurance go to: https://www.investopedia.com/terms/r/renters-insurance.asp

Answer these questions concerning renter's insurance:

1) What 3 things are usually offered in a renter's insurance policy?

2) Is the landlord responsible if a fire damages the renter's possessions?

3) What does it mean to "sublet" your apartment?

Go to: https://www.allstate.com/resources/wysw#0

Add whatever you like to your apartment. Answer the following questions:

13-Stock Project...Investing (2-Parts)

marketwatch.com

Part 1

Look up 4 stocks on market watch (at least two must have a dividend):

Copy and paste this chart.

Name:

Call letters from a US market:

52-week high and low: _______high _____low

Opening price:

Dividend (per share):

Sales/Revenue (Latest):

Sales growth, percent (Latest):

Net Income (Latest):

3-year stock price trend (+,-,0)

Analyst report (buy, sell, hold):

Year founded:

Pick a stock you think will go down in the next few days: name _____________ symbol _______ price right now________

Pick a stock you think will do well in the next few days: name____________ symbol __________price right now________

Part 2

Stock Picking...Short Selling/Margin Buyin1)

The stock you picked that you want to do poorly (go down).

1) Name________Price_______ When you short sell, you are actually borrowing shares, and selling them immediately Short Selling Chart

Stock Name and Symbol:__________________ (3 Parts

200 shares borrowed (sold) X _______Price per share (1st day)=$____________ (amount you collected)

200 shares you buy back X ________Price per share (last day)=$____________(amount you paid to buy back the shares)

subtract line 2 from line one=$_______________underline one: profit or loss

2. The stock you picked that you want to do well (go up). Name____________ Price________

When you margin buy, you are borrowing money to buy more stock.

Margin Buying Chart (using $5,000 of your money, borrowing $5,000 from your brokerage firm)

Stock Name and Symbol:____________________

$10,000/____price per share (1st day)=_______(shares you can buy...drop the decimal, no partial shares) X __________(price per share)=________(actual amount you spent of the $10,000).

number of shares you bought _________X__________price per share (last day)=________________amount you received

subtract the amount spent minus amount received=____________________underline one profit/loss

***Include your marketwatch game information***

Your name___________________Your Name in the Game______________________Rank______Net Worth $_________

14-Taxes 1 (Federal) Form: https://www.irs.gov/pub/irs-pdf/f1040.pdf Instructions: www.irs.gov/pub/irs-pdf/i1040gi.pdf

W-2 Form (single, not married, no children, not a dependent)

Employer’s name:

Best Class Ever

Happy Street

Palmyra, Va 22963

Employee’s name: "Your Name" Social security number: 123-45-6789

Wages, tips, other: $20,540.58

Federal Income Tax Withheld: $910.00

Social security wages: $20,540.52

State Income tax withheld: $185.08

Social Security Tax withheld: $100.01 Medicaid/Medicare: $91.67

(no taxable interest or other taxable income)

answer these questions...link:

https://testmoz.com/10392954

15-Taxes 2 (State)

Use the information from project 14 to fill out a Virginia Tax form 760...adjusted gross income is: $20,540

form:https: www.tax.virginia.gov/sites/default/files/taxforms/individual-income-tax/2023/760-2023.pdf

instructions: tax instructions

answer the questions, link:

https://testmoz.com/10423610

16-Home Owner's Insurance

Policy...see forms

HOME OWNERS INSURANCE WORKSHEET

Part 1 General Information

Answer the following questions using the sample policy (see forms):

6. What does “premium” mean? _______________________________________________

a. How much is the premium for this policy? ________________________________

b. What did they save on? ___________________________________

c. What is the savings amount? ______________________

Part 2 Individual Liability Limits

Other Structures

Personal Property

Personal Liability

Medical Payments for others

Water Back-up

Personal Property replacement (No amount listed)

2. Answer these questions:

a. What is the construction type? _________________________________

b. Why would year built be on the policy? _________________________________

Part 3 Other Important Information (use the numbers to look up the answers)

a. Why would you need personal liability in homeowner’s insurance?_______________________

8. Define excluded peril - _______________________________________________________

17-WILLS

You have one child...Fill in the appropriate answer. You have $100,000 for investments, you have a $250,000 home, you have a car worth $15,000, and $21,000 in the bank

LAST WILL AND TESTAMENT OF 1)__________________________(your name)

I, 2)____________________________(your name), presently of 3)_______________________(street), ________(city), Virginia, ____(zip) 4)___________(your name), am of sound mind and body declare that this is my LAST WILL and TESTAMENT on this day: __________________________.

PRELIMINARY DECLARATIONS

Prior Wills and Codicils

I revoke all prior Wills and Codicils.

Marital Status (Name, date of birth, address)

I am married to 5)_________________________________________________________.

6) Current Dependent Children (Name, date of birth, address)

If I or my spouse are unable to care for the above mentioned children, they will be assigned to the care of the following guardian:

7) ___________________________(name) ___________________________________________address

___________(relationship) _____________________________________(signature and date of the requested guardian)

PERSONAL REPRESENTATIVE

Appointment

I appoint 8)_______________________________of 9)________________________(street), 10)____________(city), Virginia,11)___(zip), as the sole Personal Representative of this WILL. The term “personal representative” in this WILL is synonymous with and includes the terms “executor” and “executrix.”

Powers of My Personal Representative

I give and appoint to My Representative the following duties and powers with respect to my estate:

Distribution of Estate

To receive any gift, property, or asset under this Will, a beneficiary must survive me for thirty (30) days. All property given under this Will is subject to any encumbrances or liens attached to the property. Any taxes associated with receiving assets or property in connection to this Will is the sole responsibility of the beneficiary and not my estate. If any named beneficiary does not survive me, then their portion of this Will shall be divided equally between the surviving beneficiaries decided by My Personal Representative. If none of my named beneficiaries survive me, or does not leave an heir, then I give, devise, and bequeath all the remaining assets of my estate to The Red Cross.

Individual Omitted from Bequests

If I have omitted to leave property in this Will to one or more of my heirs as named above, or to someone not formally mentioned in this Will, the failure to do so is intentional.

Insufficient Estate

If the value of my estate is insufficient to fulfill all the bequests or liabilities, then I give My Personal Representative full authority to decrease each bequest by a proportionate amount.

No Contest Provision

If any beneficiary under this Will contests in any court any of the provisions of this Will, then each and all such persons shall not be entitled to any devices, legacies, bequest, or benefits under this Will or any codicil hereto, and such interest or share in my estate shall be disposed of as if the contesting beneficiary had no survived me.

DISTRIBUTION

12) I leave the following to each family beneficiary listed:

Page 2 of 3

IN WITNESS WHEREOF, I have signed my name on this the 14)____day of 15)_____, 20___, declaring and publishing this instrument as My Last Will, in the presence of the undersigned witnesses, who witnessed and subscribed this Last Will at my request, and in my presence.

16)_________________________________(signature) ____________(date)

17)___________________________________(print your name)

SIGNED AND DECLARED by the following witnesses on the 18)___day of 19)_____, 20_____ in the presence of 20)________________________ (print your name), verifying that this person is of sound mind and body, and understands this is their Last Will and Testament.

Witness #1 Witness #2

21)_________________________________(signature)___________________________________

22)_________________________________(print name)__________________________________

23)_________________________________(street address)________________________________

24)_________________________________(city, state, zip)________________________________

AFFIDAVIT

STATE OF VIRGINIA

COUNTY/CITY OF 25)____________________

Before me, the witnesses 26)______________________, _______________________, and the Testator, 27)_________________________ signed the above LAST WILL AND TESTAMENT after being first duly swore, declared to me that the above instrument is being executed by 28)_______________________as their LAST WILL AND TESTAMENT, that this document was being executed voluntarily without duress, and the Testator was over the age of eighteen years, and was of sound mind and memory.

SIGNED 29)__________________________________ 30) DATE______________

OFFICIAL CAPACITY of Notary.

31) List 2 things your personal representative will do for you:_________________________

32) What would happen if you did not have enough cash to pay off all your debt?_____________________________

18-LIVING WILL

(Number from 1 -16 and fill in an appropriate answer)

Living Will Declaration

And Health Care Surrogate

1) On this ___ day of ____________,20___, I (Print Name) ________________________________

2) Of: (Mailing Address) ____________________________________________________________

3) (City and State) ____________________________________ (Zip Code) ___________________

4) Phone: (_____)_______________________________ Date of Birth: __________________

5) E-Mail Address: _____________________________________________

I willfully and voluntarily make known my desire that my dying not be artificially prolonged under the circumstances set forth below, and I do hereby declare that, if at any time I am

mentally or physically incapacitated and:

6) _______ (Initial) I have a terminal condition, or

7)_______ (Initial) I have an end-stage condition, or

8)_______ (Initial) I am in a persistent vegetative state, or

9)_______ (Initial) I am in need of a feeding tube or other life supporting devices

and if my attending or treating physician and another consulting physician have determined that there is no reasonable medical probability of my recovery from such condition, I direct that life-prolonging procedures be withheld or withdrawn when the application of such procedures would serve only to prolong artificially the process of dying, and that I be permitted to die naturally with only the administration of medication or performance of any medical procedure deemed necessary to provide me with comfort care or to alleviate pain. It is my intention that this declaration be honored by my family and physicians as the final expression of my legal right to refuse medical or surgical treatment and to accept the consequences for such refusal. In the event that I have been determined to be unable to provide expressed and informed consent regarding the withholding, withdrawal, or continuation of life-prolonging procedures, I wish to designate, as my surrogate, the executor, to carry out the provisions of this declaration, and to have the power of attorney for my estate.

10) My Name___________________________________ Phone (____) ______________________

11) Address___________________________________________Zip_____________________

12) Signature_______________________________________ Date_________________

13) Executor of this Living Will ________________________________ Phone (____) ________________

14) Address______________________________________________ Zip _________________

15) Signature_______________________________________ Date_________________

American Living Will Registry, LLC, 2814 Beach Boulevard South, St. Petersburg, FL. 33707

1-866-305-AWLR web site: www.alwr.com e-mail: [email protected]

16) What is the responsiblity of the executor of a living will?________________________________________

19-BUDGET

A - B = $__C__ (weekly take home pay) C X 4 = $___D___ (monthly take home pay)

$800/month rent $300/month for operating a car $85/month cable bill

$300/month food cost $350 monthly car payment $60/month home internet

$150/month entertainment $124/month electricity bill $30/month pet cost

$65/month water bill

1) Add your expenses (running total) until you run out of money for the month. Draw a line. List the rest of the bills. Everything below that line, you can't afford.

2) What could you do to be able to afford some of those things? List at least 3 different ways

3) For your list above write, next to each category: Fixed Expenses or Variable Expenses

20-Know Your Strengths and Weaknesses...Personality Traits

List 10 traits for each category (the example below is for one particular person...me)

Strengths Likes Need to Improve

1) Enjoys life 1) Traveling 1) Messy

2) Helping people 2) Laughing 2) Naïve

3) Organized 3) Lobster 3) Don’t know what to say when dealing with death

4) Hard worker 4) Warm weather 4) Rude to telemarketers

5) Try to stay healthy 5) Swimming 5) Too trusting

6) Enjoy teaching 6) Meeting new people 6) Drive too fast

7) Listening 7) Riding my bike 7) Better with technology

8) Good planner 8) Photography 8) Don’t floss enough

9) Easy going 9) Working out 9) Too many boots

10) Love learning new things 10) Investing 10) Not serious enough

Job Interests (list at least 3 jobs related to strengths)

Teacher, Coach, Trainer, After School Director, Stand –Up Comic

Starting My Own Business (list at least 2 businesses you could start)

Website about investing, Sports Photography, Travel Agency, Stand-Up Comic

How to improve (pick 5 things to work on)

1) Be more aware of clutter

2) Slow down when driving

3) Sell some boots

4) Patiently tell telemarketers no

5) Be careful how I joke about things

End of the Course Projects

Project I - Mergers, Acquisitions, Hostile Take Over

Requirements:

1) Definition (in business terms)

Merger

Acquisition

Hostile Take Over

2) Find an Article About an Actual Merger, Acquisition, and Hostile Take Over (one for each)...find articles that talk about a REAL company doing a merger, acquisition, and hostile take over

Title

Source

Date

Brief description of what happened (one paragraph)

Project II - Starting a Business

Requirements for the project:

1) Outline of your project or business

a) Name of your company or business

b) Employees and duties

c) What are you selling or doing

d) Where are you located

e) Contact information: address, phone, email, website

f) Opening date

g) Price list

2) Details of your business

a) Your customer base (who are you selling to)

b) Supplies

c) Equipment

d) Costs (ACTUAL DOLLAR AMOUNTS)

e) Hours of operation

3) A letter, flyer, or advertisement

a) Letter…letter head with logo, asking for a loan or an investment

b) Flyer/Computer Banner…logo, advertising opening

c) Advertisement…logo, for a newspaper or website

4) Goals for your business…plans for the future

Project III - Opinion

Write a brief description (1 paragraph for each) about the importance of:

Credit

Investing

Savings

Insurance

Banking

Budgeting

Estate Planning

Understanding the Economy

Project IV - Discussion Questions

Write at least 1 paragraph for each topic 1-7. You must cite at least one article for each topic 1-7.

1) The importance of physical health when looking at your financial health

2) The benefits and disadvantages to buying a house when compared to renting

3) The importance of leisure time

4) The monetary advantages and disadvantages of being married or single

5) The importance of an education

6) Compare owning a business to working for a business

7) List things you should do when preparing for a job interview

No articles needed:

8) List 5 goals you have for your life

9) Write one thing you thought was useful in this class

10) Write one thing you would like to see changed about this class

Project V - Decision Making, Attitude, Work Ethic (one paragraph each)

1) How do decisions you make now affect your future?

2) How is networking with people important?

3) Describe the importance of having a positive attitude.

4) What does this statement mean to you: "Good grades mean nothing without good character."

5) On oldmanmoney.com, go to the tab, "Building a Better You" and write down 3 of the most important ideas you find in that list, and explain why you chose them.

Project VI - Credit Payments (bankrate.com)

Credit Card (use this calculator from bankrate.com: credit card minimum payoff)

Project VII - 3-Stock Project

A. For each of the three companies (on the New York Stock Exchange) find:

1) What is its symbol?

2) What do the analysts suggest?

3) What is its financial data?

a) Current price

b) EPS

c) Dividend

d) 52-week high and low

e) Sales/revenue

f) % sales growth

g) Net Incomes

h) 5 year trend

i) P/E Ratio

4) Follow the price for each over a three day period

5) Calculate the % increase or % decrease for each stock price

Which stock would have been the best investment and why?

Project VIII: Writing all words and definitions

Use Quizlet "End of Year Project VIII" and hand write all the words and definitions in that lesson

(take a picture of your work and email it to me)

Project IX: Investing vs Savings

1) What is the difference between investing and savings?

2) Describe how compound interest works.

3) What is the "Rule 72" and give an example.

4) Define diversification and tell why it is important.

5) Describe each and give one advantage and one disadvantage to owning:

savings account, CD (certificate of deposit), mutual funds, bonds, and stocks

Project X: Budgeting Project (per month)

(use 30 days in a month)***

Questions:

1) If you wanted to have the minimum amount (3 months) in your savings for emergencies, how long would it take you to save that amount?

2) If the cost of gas were to increase to $4.00 per gallon, where would you cut expenses to cover the increase in your gas expense?

3) The average cost of raising a child every month until age 18 is about $1100 excluding college. What

would you have to do to pay this expense?

Proudly powered by Weebly

Compare Wells Fargo vs Ally

1) Savings account rate (APY), opening deposit, minimum balance, monthly fee (find these numbers)

2) 1 year CD rate (APY), minimum required (if they have one)

3) Other banking opportunities each bank offers...student loans, car loans, etc. (list at least 3)

4) List 3 reasons why you might choose Wells Fargo over Ally

5) List 3 reasons you would choose Ally over Wells Fargo

6) Compare the savings interest rates between 3 other online banks (besides Ally)

4-Banking Worksheets (VIRTUAL ONLY)

(You can find the deposit form in the section labeled "FORMS")

Deposit 1:

Today’s date

Wal-Mart check…$230.78

Weekend work check…$100.00

Birthday check…$20.00

Cash from yard sale…5-$20, 6-$10, 2-$5, 7-$1, 81 quarters, 2 dimes, 20 nickels

Deposit 2:

Today’s date

Paycheck…$258.67

Cutting grass check…$176.87

Cutting grass cash…1-$50, 6-$20, 3-$5, 1-$1, 8 half dollars, 40 quarters, 5 dimes, I nickel, 1 penny

Deposit 3

Today’s date

Extended Education pay check…$150.98

Frank Miller’s check for babysitting…$45.00

Take out $50.00 cash for the weekend

Make a register for each:

(You can find the register form in the section labeled "FORMS")

A-previous balance=$1,235.65 B-previous balance=$456.42

#1234 8/2 K-Mart $123.56 #567 9/3 Sears $207.89

8/6 Paycheck $239.12 #568 9/4 Wal-Mart $178.09

#1235 8/10 Subway $10.50 9/6 Paycheck $245.78

#1236 8/23 Lowes $45.01 #569 9/10 Insurance payment $390.00

8/30 Paycheck $324.24 9/12 Overdraft charge $50.00

9/3 Weekend work check $125.98 9/13 Paycheck $300.00

#1237 9/10 Birthday gift $25.00

__________________________________________________________________________________________________________

Balancing a checkbook...Your friend asks for your help. She doesn't understand why her register doesn't match the bank's number. Can you help her?

Number Date Transaction Withdrawal Deposit previous balance: $532.91

#325 2/15 Krogers 256.78 276.13

2/19 Paycheck 210.32 486.45

#327 2/25 Dominion Power 214.63 271.82

#328 2/27 Sears 63.19 208.63

3/1 Paycheck 197.42 406.05

Bank statement = $328.10

Why the difference? _____________________________________________________

Balancing a checkbook... Another friend asks for your help. He doesn't understand why his register doesn't match the bank's number. Can you help him?

previous balance: $379.61

#103 9/17 Toys R Us 123.72 255.89

#104 9/20 Food Lion 98.67 157.22

9/20 Paycheck 356.81 504.03

#105 9/21 Merchant’s 320.78 183.25

#106 9/22 Wal-Mart 45.29 137.96

Bank Statement = $147.96 Why the difference? ________________________________

_________________________________________________________________________________________________________

5-Credit Card Project (bankrate.com)...4 Parts!

Part I: Credit Cards...go to bankrate.com...click on credit card... Find "Compare by credit"

Find a credit card for each column:

Name of Card Card 1 Card 2 Card 3

Rating Excellent Good Bad

Intro Offer

(annual percentage rate)

Regular APR

Transfer Balance APR

Annual Fee

Rewards

Part II: Write the definition of “Line of Credit”

Part III: Credit Card Minimum Payoff

bankrate.com

- click on the context icon, click on Credit cards > find "Tools and Review" then look for "Credit card payoff calculator"

- $2,000 credit card balance

- 16% interest rate

- Minimum payment of $27 per month

- Find: Total payment (principal + interest), total interest, time to pay it off in years + months

Part IV: Credit Card Article

1. go to: https://www.nasdaq.com/article/simply-saying-the-best-advice-about-credit-cards-youve-ever-heard-cm409844

2. Read then write 3 things that you agree or disagree with about the article.

6-Buying a Car/Truck

Kelley Blue Book (kbb.com) Part 1

- Look up one new and one used vehicle you would like to buy.

- Name

- Year/ Model/Mileage (used vehicle)

- Options

- New Vehicle: List the MSRP and the Fair Purchase Range (high and low)

- Used: Look up the price for the used car (high and low range). How many miles does it have?

- Go to Loans...Use Calculators...Loan Calculator

- Use your MSRP for the new vehicle from above

- Use a 5 year loan

- Find the monthly payment, total interest paid, final cost of the vehicle (principal + interest) using each interest rate: 1.99%, 4.5%, 5%...make a chart: Monthly payment total interest total cost 1.99% 4.5% 5%

- How much did you save in total interest paid comparing 1.99% to 5%, and 4.5% to 5%?

- Find the total interest and the monthly payments if had a 3 year loan @1.99%. How do these compare to the same loan for 5 years...Which is more for each: interest? monthly payment?

- Write the first and last lines of the amortization table for just the 1.99% interest rate for a 3 year loan.

- Use the lowest price from the "Fair Price Range" to figure a 5 year loan at 4.5%. How much did you save in interest by negotiating a lower price?

7-Housing Project

House costing: find using Zillow

Description of your house: location, price (listed not estimate), # of rooms, square footage, # of bathrooms, size of the lot, age

If you used a FHA loan (Federal Housing Administration loan), you would need a 3.5% down payment.

down payment= cost of your home X .035 (write this down)

cost of your home - down payment = amount financed<---use in the problem for the amount borrowed

remember: the total cost of your home is the original price + the total interest paid

Bankrate.com

- amount financed (from up above): $______________________ (use this number in the loan calculator)

- Loan Calculator

- Chart of first 3 lines listed on the amortization table for an interest rate of 6% for a 30 year mortgage:

Monthly Payment Total Interest (whole length of the loan) Total Cost (original price + the total interest paid)

15 years:

6% ______________________

7% ____________

30 Years:

6% ____________

7% ____________

Q-1 What did you notice about the difference in total interest for the 15 year loan when compared to the 30 year loan? Total interest for 6% when compared to 7%. How much did you save in total interest by lowering your rate by 1% with a 30 year loan?

Q-2 What did you notice about the monthly payments for a 15 year loan compared to a 30 year loan? Monthly payment for 6% when compared to 7% with a 30 year loan...how much did you save?

Q-3 Using the amortization table for a 30 year loan at 7% interest rate, what do you notice about the amount of your payment that goes towards the principal and the interest in the beginning?

***Don't forget to negotiate your interest rate as well as the price of your home...save thousands!!!***

8-Car Insurance: https://www.moneygeek.com/insurance/auto/car-insurance-estimate-calculator/

Copy the following chart in a Google Doc and complete...

Female age: 30-65 Credit: excellent Driving record: clean vehicle type: sedan

Liability coverage: State Min Deductible: $500

Rates: Low_______ Average______High______

Change the age to 19-22

Rates: Low_______ Average______High______ What did you notice? ______________________________________

Why the change in price?_____________________________________________________

Change the Credit to Poor

Rates: Low_______ Average______High______ What did you notice? ______________________________________

Why do people with a low credit score have to pay more?_____________________________________________________

Change the Credit back to excellent and change the Gender to male

Rates: Low_______ Average______High______ What did you notice when comparing this number to a female driver? ________________________________________________________________

Why the change in price?_____________________________________________________

Change the Age to 23-25

Rates: Low _______ Average______High______ What did you notice? ______________________________________

Why the change in price?_____________________________________________________

Change the Driving Record to speeding

Rates: Low _______ Average______High______ What did you notice? ______________________________________

Why the change in price?_____________________________________________________

Change the Driving Record to accident

Rates: Low _______ Average______High______ What did you notice? ______________________________________

Why the change in price?_____________________________________________________

Change the Driving Record back to clean and change the deductible to $1,000

Rates: Low _______ Average______High______ What did you notice? ______________________________________

Why the change in price?_____________________________________________________

9-Car Insurance...Accident

Maria Andretti purchased an automobile insurance policy through an insurance agent

at the Wilson Insurance Agency. She paid a premium of $120 per month. Her policy includes the following:

• Bodily injury liability and property damage liability,

stated as “50/100/20”

• Collision insurance with a deductible of $1000

• Comprehensive insurance with a deductible of $500

Assume Maria is driving her car with a friend and is involved in an accident that was her fault. The driver also has a passenger in the car. Everyone – drivers and passengers – sustain injuries and require medical care.

- What is the maximum amount Maria is covered for bodily injury for a whole accident? __________

- What is the maximum amount Maria is covered for property damage? ___________

- If the driver of the other car sustained $30,000 of medical bills, how much will the insurance company pay? _____

- If the medical bills were as follows: passenger in her car sustained $20,000, passenger in the other car sustained $15,000, and the driver sustained $30,000, how much of the bodily liability will the insurance company pay? _______________

- The other car had $21,000 of damages, how much will the insurance company pay? ____________

- Maria’s car had $3,500 worth of damages to her car, how much will the insurance company pay? ______________

- Maria needed medical care totaling $4,000. How much will the Wilson Insurance Agency have to pay? _________________

- If Maria had destroyed a fence during her accident which cost $2,000 to repair, how much would the insurance company pay for the repair? _______________

- Maria has had a string of bad luck. Right after her accident, she had her car broken into by thieves. They stole $200 worth of CDs, a $500 cell phone, and her $1000 laptop. The side car window was broken, and it cost $700 to fix. How much did the Wilson Insurance Agency have to pay? _____________________

- If Maria lowered her deductible, what would that do to her premium? _____________

- How much per year does Maria pay for her car insurance with The Wilson Insurance Agency? _____

- If Maria decided to increase her bodily liability numbers to 100/200/40, what would this do to her premium?____

10-Health Insurance Numbers

- $1000.00 deductible

- $20 copay for doctor visits and prescription drugs (does not count towards their deductible

- 90% coverage for doctor visits after the co-payment and deductible

- 50% coverage for eye care/glasses after the co-payment and deductible

- 80% coverage for hospital care/operations after the deductible (no co-pay required)

- No dental care or dentist visits

- Premium for this policy is $50 per month

- If a person went to a doctor for a check-up where the total cost was $320.00, how much would the insurance company have to pay? Person pay?

- After his visit to his primary care doctor, this person had to have an operation that cost $1,500. How much will the insurance company pay? Person pay?

- If the total for a dental bill was $500, how much did the insurance company pay? Person pay?

- This person went to their eye care doctor and had a charge of $220 for the visit and $550 for glasses. How much did the insurance company pay? Person pay?

- This person went to their primary care taker and the doctor wrote a prescription for a medication that cost $100 per month. How much did the insurance company pay for the year? Person pay?

- How much did this policy cost the person for a year, excluding all the medical bills?

11-Finding Health Insurance

https://www.ehealthinsurance.com/

22963 zip code...go to "Individual and Family." Click on "Find Plans" Go to "Get Quote"....Fill out the information using the data below. Click on "See Plans."

- Not a Business Owner

- Choose either Male or Female

- Birth date: 01/01/2000

- Tobacco use...I hope NO!

- No other coverage

- Skip and See Plans

- Click on "More plan detail"

- Pick 2 plans with different deductibles

Name of Policy 1st Policy 2nd Policy

The deductible:

Premium per month:

Co-Insurance:

Out of pocket limit:

Are prescription drugs covered?

Primary doctor copay:

Specialist copay:

Cost of hospital services:

Answer the following questions:

What is a copay?

If your insurance company covers 80% of the coinsurance, what does that mean?

What is an out of pocket limit?

Click on select plan. How much would it cost per month to add dental? ________ to add vision? ______

Comparing your two policies, why is the premium more for one over the other?

12-Home Owner's Insurance/ Renter's Insurance

Go to the following website...https://www.investopedia.com/insurance/homeowners-insurance-guide/

Answer these questions for home owner's insurance:

1) What does a home owner's policy cover? (list 3 things)

2) What is the difference between actual cash value and replacement cost?

3) What is a rider policy?

4) What is generally not covered under your homeowner's policy that requires an additional policy? (list 3)

5) What does liability cover?

6) What is additional living expense?

7) The premium for your homeowner's policy is determined by what factors? (list 3)

For renter's insurance go to: https://www.investopedia.com/terms/r/renters-insurance.asp

Answer these questions concerning renter's insurance:

1) What 3 things are usually offered in a renter's insurance policy?

2) Is the landlord responsible if a fire damages the renter's possessions?

3) What does it mean to "sublet" your apartment?

Go to: https://www.allstate.com/resources/wysw#0

Add whatever you like to your apartment. Answer the following questions:

- How much is your stuff worth? ______________________

- Click: Get Covered...Choose a disposable income around $500. What number did you choose? ______

- How long would it take to replace your "stuff?" _______________

- How much per month would it cost to insure your "stuff?" _________________

13-Stock Project...Investing (2-Parts)

marketwatch.com

Part 1

Look up 4 stocks on market watch (at least two must have a dividend):

Copy and paste this chart.

Name:

Call letters from a US market:

52-week high and low: _______high _____low

Opening price:

Dividend (per share):

Sales/Revenue (Latest):

Sales growth, percent (Latest):

Net Income (Latest):

3-year stock price trend (+,-,0)

Analyst report (buy, sell, hold):

Year founded:

Pick a stock you think will go down in the next few days: name _____________ symbol _______ price right now________

Pick a stock you think will do well in the next few days: name____________ symbol __________price right now________

Part 2

Stock Picking...Short Selling/Margin Buyin1)

The stock you picked that you want to do poorly (go down).

1) Name________Price_______ When you short sell, you are actually borrowing shares, and selling them immediately Short Selling Chart

Stock Name and Symbol:__________________ (3 Parts

200 shares borrowed (sold) X _______Price per share (1st day)=$____________ (amount you collected)

200 shares you buy back X ________Price per share (last day)=$____________(amount you paid to buy back the shares)

subtract line 2 from line one=$_______________underline one: profit or loss

2. The stock you picked that you want to do well (go up). Name____________ Price________

When you margin buy, you are borrowing money to buy more stock.

Margin Buying Chart (using $5,000 of your money, borrowing $5,000 from your brokerage firm)

Stock Name and Symbol:____________________

$10,000/____price per share (1st day)=_______(shares you can buy...drop the decimal, no partial shares) X __________(price per share)=________(actual amount you spent of the $10,000).

number of shares you bought _________X__________price per share (last day)=________________amount you received

subtract the amount spent minus amount received=____________________underline one profit/loss

***Include your marketwatch game information***

Your name___________________Your Name in the Game______________________Rank______Net Worth $_________

14-Taxes 1 (Federal) Form: https://www.irs.gov/pub/irs-pdf/f1040.pdf Instructions: www.irs.gov/pub/irs-pdf/i1040gi.pdf

W-2 Form (single, not married, no children, not a dependent)

Employer’s name:

Best Class Ever

Happy Street

Palmyra, Va 22963

Employee’s name: "Your Name" Social security number: 123-45-6789

Wages, tips, other: $20,540.58

Federal Income Tax Withheld: $910.00

Social security wages: $20,540.52

State Income tax withheld: $185.08

Social Security Tax withheld: $100.01 Medicaid/Medicare: $91.67

(no taxable interest or other taxable income)

answer these questions...link:

https://testmoz.com/10392954

15-Taxes 2 (State)

Use the information from project 14 to fill out a Virginia Tax form 760...adjusted gross income is: $20,540

form:https: www.tax.virginia.gov/sites/default/files/taxforms/individual-income-tax/2023/760-2023.pdf

instructions: tax instructions

answer the questions, link:

https://testmoz.com/10423610

16-Home Owner's Insurance

Policy...see forms

HOME OWNERS INSURANCE WORKSHEET

Part 1 General Information

Answer the following questions using the sample policy (see forms):

- What is the name of the insurance company? _______________________________

- What is the term length of the policy? ______________________________

- What is the email address for the agent?_______________________________________

- Who will be billed for the premium amount?_____________________________

6. What does “premium” mean? _______________________________________________

a. How much is the premium for this policy? ________________________________

b. What did they save on? ___________________________________

c. What is the savings amount? ______________________

Part 2 Individual Liability Limits

- Description Limit Amounts Premium

Other Structures

Personal Property

Personal Liability

Medical Payments for others

Water Back-up

Personal Property replacement (No amount listed)

2. Answer these questions:

a. What is the construction type? _________________________________

b. Why would year built be on the policy? _________________________________

Part 3 Other Important Information (use the numbers to look up the answers)

- What is the deductible for this policy? _________________

- Define deductible - _________________________________________________________

- Define dwelling - ___________________________________________________________

- What does “other structure” cover? ____________________________________________

- What does “personal property” cover? _________________________________________

- Explain “loss of use” #16 _____________________________________________________

a. Why would you need personal liability in homeowner’s insurance?_______________________

8. Define excluded peril - _______________________________________________________

17-WILLS

You have one child...Fill in the appropriate answer. You have $100,000 for investments, you have a $250,000 home, you have a car worth $15,000, and $21,000 in the bank

LAST WILL AND TESTAMENT OF 1)__________________________(your name)

I, 2)____________________________(your name), presently of 3)_______________________(street), ________(city), Virginia, ____(zip) 4)___________(your name), am of sound mind and body declare that this is my LAST WILL and TESTAMENT on this day: __________________________.

PRELIMINARY DECLARATIONS

Prior Wills and Codicils

I revoke all prior Wills and Codicils.

Marital Status (Name, date of birth, address)

I am married to 5)_________________________________________________________.

6) Current Dependent Children (Name, date of birth, address)

- ________________________________________________________________

- ________________________________________________________________

- ________________________________________________________________

- ________________________________________________________________

If I or my spouse are unable to care for the above mentioned children, they will be assigned to the care of the following guardian:

7) ___________________________(name) ___________________________________________address

___________(relationship) _____________________________________(signature and date of the requested guardian)

PERSONAL REPRESENTATIVE

Appointment

I appoint 8)_______________________________of 9)________________________(street), 10)____________(city), Virginia,11)___(zip), as the sole Personal Representative of this WILL. The term “personal representative” in this WILL is synonymous with and includes the terms “executor” and “executrix.”

Powers of My Personal Representative

I give and appoint to My Representative the following duties and powers with respect to my estate:

- To pay my legally enforceable debts, funeral expenses, and all expenses in connection with the administration of my estate and the trust of My Will as soon as convenient after my death.

- To have the Power of Attorney for any necessary forms, documents, or other paperwork necessary to complete their duties as My Personal Representative.

- To take all legal actions necessary to execute the desires of My Will completely as governed by the laws of the Commonwealth of Virginia.

- To employ any lawyer, accountant, or other professional they deem necessary for the execution of My Will.

- To convert or liquidate investments or securities without liability for losses, and distribute the cash value to the designated beneficiaries.

- To close bank accounts and transfer assets to designated beneficiaries.

- To settle, abandon, sue, or defend any lawsuits against my estate.

- To distribute all assets and personal property according to my wishes as outlined in this Will.

- Authority and powers granted to My Personal Representative are in addition to any powers and elective rights conferred by state or federal law or by other provisions of this Will, and may be exercised as often as required, and without application to or approval by any court.

Distribution of Estate

To receive any gift, property, or asset under this Will, a beneficiary must survive me for thirty (30) days. All property given under this Will is subject to any encumbrances or liens attached to the property. Any taxes associated with receiving assets or property in connection to this Will is the sole responsibility of the beneficiary and not my estate. If any named beneficiary does not survive me, then their portion of this Will shall be divided equally between the surviving beneficiaries decided by My Personal Representative. If none of my named beneficiaries survive me, or does not leave an heir, then I give, devise, and bequeath all the remaining assets of my estate to The Red Cross.

Individual Omitted from Bequests

If I have omitted to leave property in this Will to one or more of my heirs as named above, or to someone not formally mentioned in this Will, the failure to do so is intentional.

Insufficient Estate

If the value of my estate is insufficient to fulfill all the bequests or liabilities, then I give My Personal Representative full authority to decrease each bequest by a proportionate amount.

No Contest Provision

If any beneficiary under this Will contests in any court any of the provisions of this Will, then each and all such persons shall not be entitled to any devices, legacies, bequest, or benefits under this Will or any codicil hereto, and such interest or share in my estate shall be disposed of as if the contesting beneficiary had no survived me.

DISTRIBUTION

12) I leave the following to each family beneficiary listed:

- _________________________________________________

- _________________________________________________

- _________________________________________________

- _________________________________________________

- _________________________________________________

- _________________________________________________________________

- _________________________________________________________________

- _________________________________________________________________

Page 2 of 3

IN WITNESS WHEREOF, I have signed my name on this the 14)____day of 15)_____, 20___, declaring and publishing this instrument as My Last Will, in the presence of the undersigned witnesses, who witnessed and subscribed this Last Will at my request, and in my presence.

16)_________________________________(signature) ____________(date)

17)___________________________________(print your name)

SIGNED AND DECLARED by the following witnesses on the 18)___day of 19)_____, 20_____ in the presence of 20)________________________ (print your name), verifying that this person is of sound mind and body, and understands this is their Last Will and Testament.

Witness #1 Witness #2

21)_________________________________(signature)___________________________________

22)_________________________________(print name)__________________________________

23)_________________________________(street address)________________________________

24)_________________________________(city, state, zip)________________________________

AFFIDAVIT

STATE OF VIRGINIA

COUNTY/CITY OF 25)____________________

Before me, the witnesses 26)______________________, _______________________, and the Testator, 27)_________________________ signed the above LAST WILL AND TESTAMENT after being first duly swore, declared to me that the above instrument is being executed by 28)_______________________as their LAST WILL AND TESTAMENT, that this document was being executed voluntarily without duress, and the Testator was over the age of eighteen years, and was of sound mind and memory.

SIGNED 29)__________________________________ 30) DATE______________

OFFICIAL CAPACITY of Notary.

31) List 2 things your personal representative will do for you:_________________________

32) What would happen if you did not have enough cash to pay off all your debt?_____________________________

18-LIVING WILL

(Number from 1 -16 and fill in an appropriate answer)

Living Will Declaration

And Health Care Surrogate

1) On this ___ day of ____________,20___, I (Print Name) ________________________________

2) Of: (Mailing Address) ____________________________________________________________

3) (City and State) ____________________________________ (Zip Code) ___________________

4) Phone: (_____)_______________________________ Date of Birth: __________________

5) E-Mail Address: _____________________________________________

I willfully and voluntarily make known my desire that my dying not be artificially prolonged under the circumstances set forth below, and I do hereby declare that, if at any time I am

mentally or physically incapacitated and:

6) _______ (Initial) I have a terminal condition, or

7)_______ (Initial) I have an end-stage condition, or

8)_______ (Initial) I am in a persistent vegetative state, or

9)_______ (Initial) I am in need of a feeding tube or other life supporting devices

and if my attending or treating physician and another consulting physician have determined that there is no reasonable medical probability of my recovery from such condition, I direct that life-prolonging procedures be withheld or withdrawn when the application of such procedures would serve only to prolong artificially the process of dying, and that I be permitted to die naturally with only the administration of medication or performance of any medical procedure deemed necessary to provide me with comfort care or to alleviate pain. It is my intention that this declaration be honored by my family and physicians as the final expression of my legal right to refuse medical or surgical treatment and to accept the consequences for such refusal. In the event that I have been determined to be unable to provide expressed and informed consent regarding the withholding, withdrawal, or continuation of life-prolonging procedures, I wish to designate, as my surrogate, the executor, to carry out the provisions of this declaration, and to have the power of attorney for my estate.

10) My Name___________________________________ Phone (____) ______________________

11) Address___________________________________________Zip_____________________

12) Signature_______________________________________ Date_________________

13) Executor of this Living Will ________________________________ Phone (____) ________________

14) Address______________________________________________ Zip _________________

15) Signature_______________________________________ Date_________________

American Living Will Registry, LLC, 2814 Beach Boulevard South, St. Petersburg, FL. 33707

1-866-305-AWLR web site: www.alwr.com e-mail: [email protected]

16) What is the responsiblity of the executor of a living will?________________________________________

19-BUDGET

- You make $16.00/hour for a 40 hour work week. Approximately: 20% is taken out for taxes and FICA. Figure your take home pay per month (assuming you work 4 full weeks). What is your gross pay? What is your net pay?

A - B = $__C__ (weekly take home pay) C X 4 = $___D___ (monthly take home pay)

- From the expenses below, make a list beginning with the most important to the least important (include the cost):

$800/month rent $300/month for operating a car $85/month cable bill

$300/month food cost $350 monthly car payment $60/month home internet

$150/month entertainment $124/month electricity bill $30/month pet cost

$65/month water bill

1) Add your expenses (running total) until you run out of money for the month. Draw a line. List the rest of the bills. Everything below that line, you can't afford.

2) What could you do to be able to afford some of those things? List at least 3 different ways

3) For your list above write, next to each category: Fixed Expenses or Variable Expenses

20-Know Your Strengths and Weaknesses...Personality Traits

List 10 traits for each category (the example below is for one particular person...me)

Strengths Likes Need to Improve

1) Enjoys life 1) Traveling 1) Messy

2) Helping people 2) Laughing 2) Naïve

3) Organized 3) Lobster 3) Don’t know what to say when dealing with death

4) Hard worker 4) Warm weather 4) Rude to telemarketers

5) Try to stay healthy 5) Swimming 5) Too trusting

6) Enjoy teaching 6) Meeting new people 6) Drive too fast

7) Listening 7) Riding my bike 7) Better with technology

8) Good planner 8) Photography 8) Don’t floss enough

9) Easy going 9) Working out 9) Too many boots

10) Love learning new things 10) Investing 10) Not serious enough

Job Interests (list at least 3 jobs related to strengths)

Teacher, Coach, Trainer, After School Director, Stand –Up Comic

Starting My Own Business (list at least 2 businesses you could start)

Website about investing, Sports Photography, Travel Agency, Stand-Up Comic

How to improve (pick 5 things to work on)

1) Be more aware of clutter

2) Slow down when driving

3) Sell some boots

4) Patiently tell telemarketers no

5) Be careful how I joke about things

End of the Course Projects

Project I - Mergers, Acquisitions, Hostile Take Over

Requirements:

1) Definition (in business terms)

Merger

Acquisition

Hostile Take Over

2) Find an Article About an Actual Merger, Acquisition, and Hostile Take Over (one for each)...find articles that talk about a REAL company doing a merger, acquisition, and hostile take over

Title

Source

Date

Brief description of what happened (one paragraph)

Project II - Starting a Business

Requirements for the project:

1) Outline of your project or business

a) Name of your company or business

b) Employees and duties

c) What are you selling or doing

d) Where are you located

e) Contact information: address, phone, email, website

f) Opening date

g) Price list

2) Details of your business

a) Your customer base (who are you selling to)

b) Supplies

c) Equipment

d) Costs (ACTUAL DOLLAR AMOUNTS)

e) Hours of operation

3) A letter, flyer, or advertisement

a) Letter…letter head with logo, asking for a loan or an investment

b) Flyer/Computer Banner…logo, advertising opening

c) Advertisement…logo, for a newspaper or website

4) Goals for your business…plans for the future

Project III - Opinion

Write a brief description (1 paragraph for each) about the importance of:

Credit

Investing

Savings

Insurance

Banking

Budgeting

Estate Planning

Understanding the Economy

Project IV - Discussion Questions

Write at least 1 paragraph for each topic 1-7. You must cite at least one article for each topic 1-7.

1) The importance of physical health when looking at your financial health

2) The benefits and disadvantages to buying a house when compared to renting

3) The importance of leisure time

4) The monetary advantages and disadvantages of being married or single

5) The importance of an education

6) Compare owning a business to working for a business

7) List things you should do when preparing for a job interview

No articles needed:

8) List 5 goals you have for your life

9) Write one thing you thought was useful in this class

10) Write one thing you would like to see changed about this class

Project V - Decision Making, Attitude, Work Ethic (one paragraph each)

1) How do decisions you make now affect your future?

2) How is networking with people important?

3) Describe the importance of having a positive attitude.

4) What does this statement mean to you: "Good grades mean nothing without good character."

5) On oldmanmoney.com, go to the tab, "Building a Better You" and write down 3 of the most important ideas you find in that list, and explain why you chose them.

Project VI - Credit Payments (bankrate.com)

Credit Card (use this calculator from bankrate.com: credit card minimum payoff)

- If you had a credit card balance of $3,000, how long (in years) would it take you to pay off that debt if you paid 3% each month at an interest rate of 15%.

- How much would the total cost be including the principle and the interest?

- In problem 1, change the interest rate to 24.99% and find the length of time and the total payment.

- If you bought a house for $250,000 at a 3.5% interest rate on a 30 year loan with a $10,000 down payment:

- How much is your monthly payment?

- How much interest will you pay after 30 years?

- What was your total cost for your house after 30 years?

- Find the monthly payment, and the total interest paid for a car, and the total cost of the car (cost of the car + total interest):

- $20,000

- 5 year loan

- 3% interest rate

Project VII - 3-Stock Project

A. For each of the three companies (on the New York Stock Exchange) find:

1) What is its symbol?

2) What do the analysts suggest?

3) What is its financial data?

a) Current price

b) EPS

c) Dividend

d) 52-week high and low

e) Sales/revenue

f) % sales growth

g) Net Incomes

h) 5 year trend

i) P/E Ratio

4) Follow the price for each over a three day period

5) Calculate the % increase or % decrease for each stock price

Which stock would have been the best investment and why?

Project VIII: Writing all words and definitions

Use Quizlet "End of Year Project VIII" and hand write all the words and definitions in that lesson

(take a picture of your work and email it to me)

Project IX: Investing vs Savings

1) What is the difference between investing and savings?

2) Describe how compound interest works.

3) What is the "Rule 72" and give an example.

4) Define diversification and tell why it is important.

5) Describe each and give one advantage and one disadvantage to owning:

savings account, CD (certificate of deposit), mutual funds, bonds, and stocks

Project X: Budgeting Project (per month)

- Finding a job/pay

- Use this site to find a job: http://www.bls.gov/oes/current/oes_nat.htm#25-0000

- Find a job that is $60,000 or less (name, pay, and what you will be doing)

- Find your monthly gross income

- Find your net monthly income (take home pay) by subtracting out 20% for taxes and FICA

- Housing Expenses

- Use this site to find a home: http://www.zillow.com/charlottesville-va/

- Write down the address, price, estimated monthly mortgage payment

- Basic formula for estimating house insurance: cost of house divided by 1000 then multiply by $3.50...this is per year so you need to divide by 12 for your monthly cost

- Car Expenses

- Kelley Blue Book…Name, options, price, miles per gallon

- Find payment on bankrate.com…3.5% interest rate for a 5 year loan

- Find your insurance payment on thegeneral.com (use the parameters from the class project in the above section)

- Find the monthly cost of commuting (to and from) using:

- Average Commute Times | WNYCproject.wnyc.org/commute-times-us/embed.html

- Use the average speed of 30mph

- Find gas used...commute time x 2 (to and from work) divided by 60 (find the hours traveled)x20 (number of days working)x30mph (find the number of miles traveled) divided by MPG for your car to find the number of gallons used.

- Use $2.50 per gallon as your price

- Use 20 miles a day for personal use of your car (in addition to the work mileage)...20 x 30(days in a month) divided by MPG for your car to find the gallons used

- Use 7 cents per mile for general maintenance (add work miles and personal miles)

- Write all your vehicle expenses

- Food Expenses per month

- 20% of your net income

- Utilities per month

- 10% of your net income

- Medical Expenses per month

- 10% of your net income

- Other Budget Items per month

- Clothes

- Cell Phone

- Entertainment

- Savings (Emergency Fund)

- Investing

(use 30 days in a month)***

Questions:

1) If you wanted to have the minimum amount (3 months) in your savings for emergencies, how long would it take you to save that amount?

2) If the cost of gas were to increase to $4.00 per gallon, where would you cut expenses to cover the increase in your gas expense?

3) The average cost of raising a child every month until age 18 is about $1100 excluding college. What

would you have to do to pay this expense?

Proudly powered by Weebly